how to trade bull flag

Pay Attention to the Resistance. The SP 500 Emini futures formed an Emini wedge bull flag on the Monthly chart.

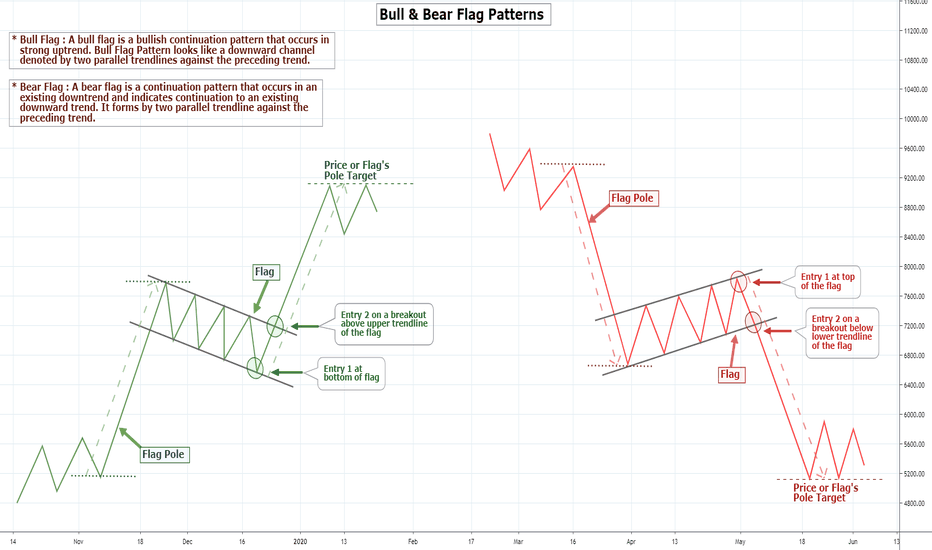

How To Trade Bull Bear Flag Pattern Flag Pattern Tutorial For Bitstamp Btcusd By Haque Stockszone Tradingview

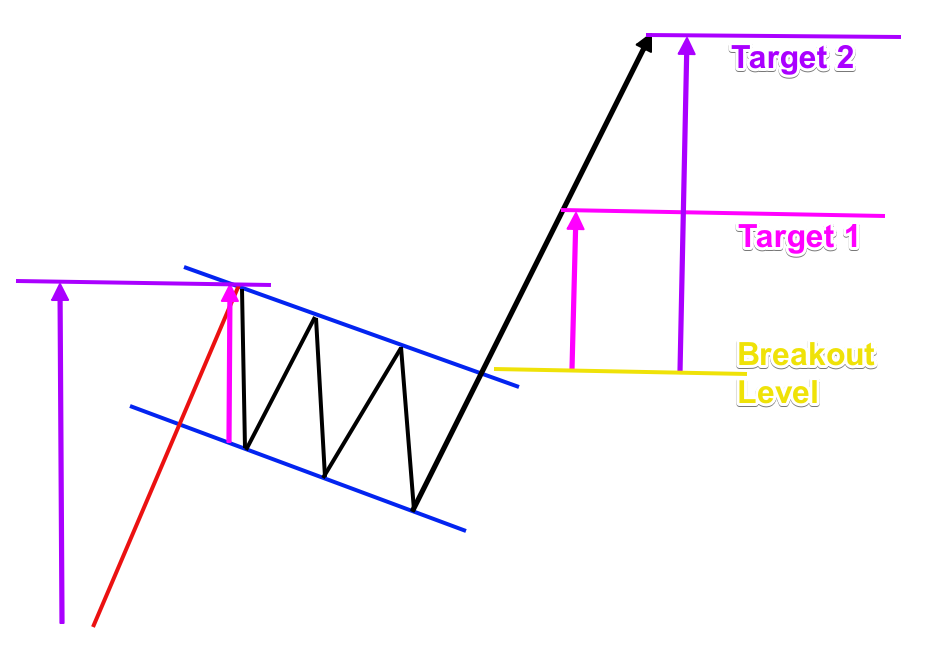

This retracement helps form what is considered the flag while the initial uptrend is the flag pole.

. You may say its a bull flag. The retracement should not be less than 38 and its not a bull flag even if it is below. He likes to take advantage of the bullish.

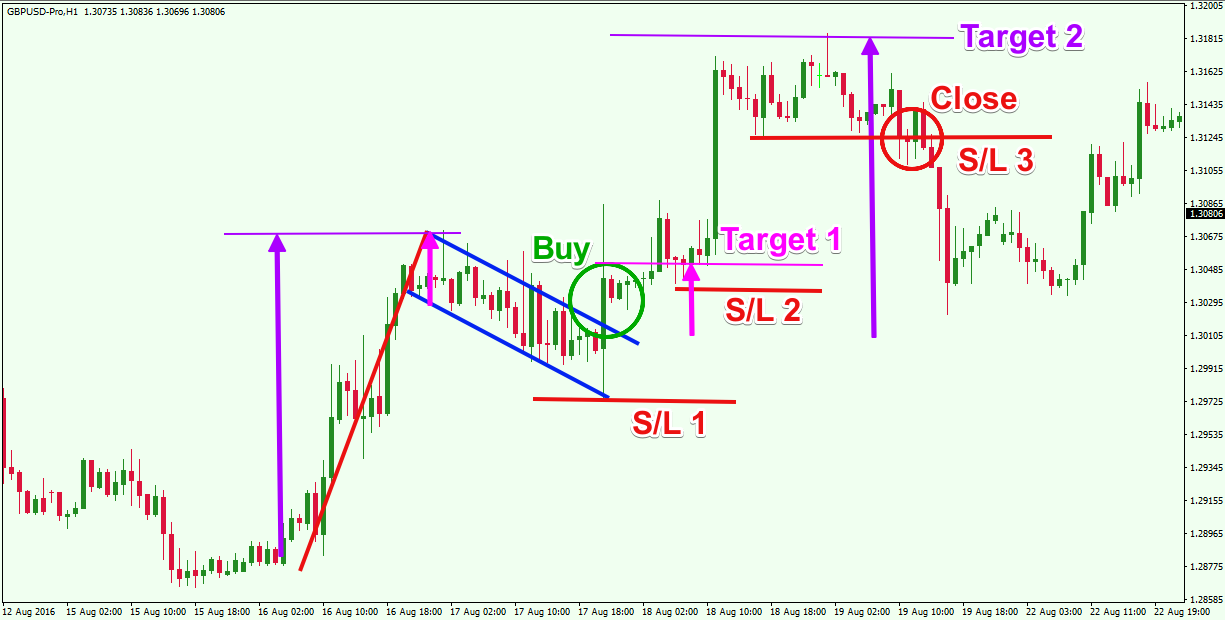

To be clear pivot point bounce trades should be held at least until the price action reaches the next level on the chart. Traders use this chart pattern to make good trade decisions. Follow the steps below and you can quickly integrate the bull flag into your forex trading.

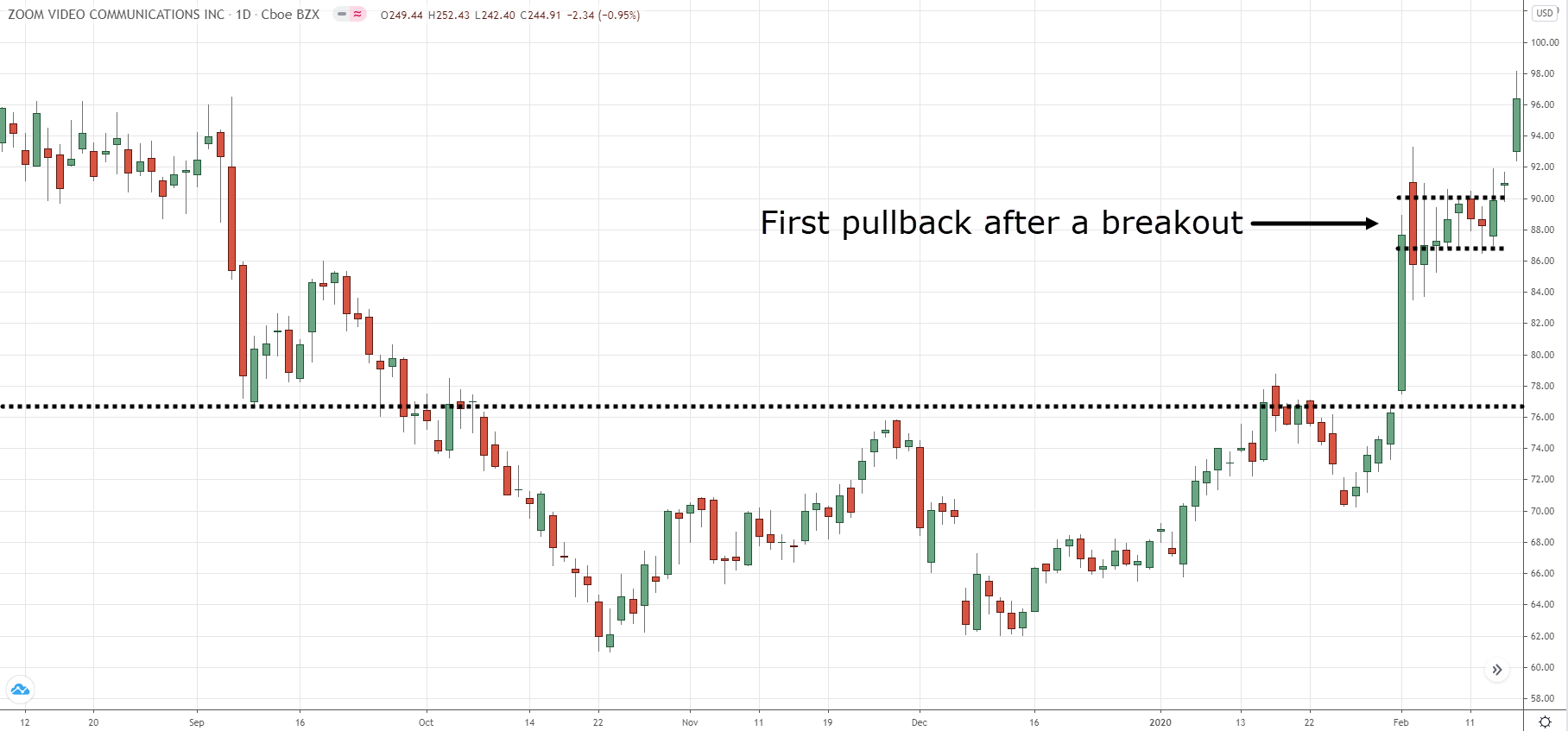

On the weekly chart it is in a pullback phase after a strong rally from October low. The resistance is the most important thing to watch on a bull flag pattern. Identify an evolving uptrend in an FX pair.

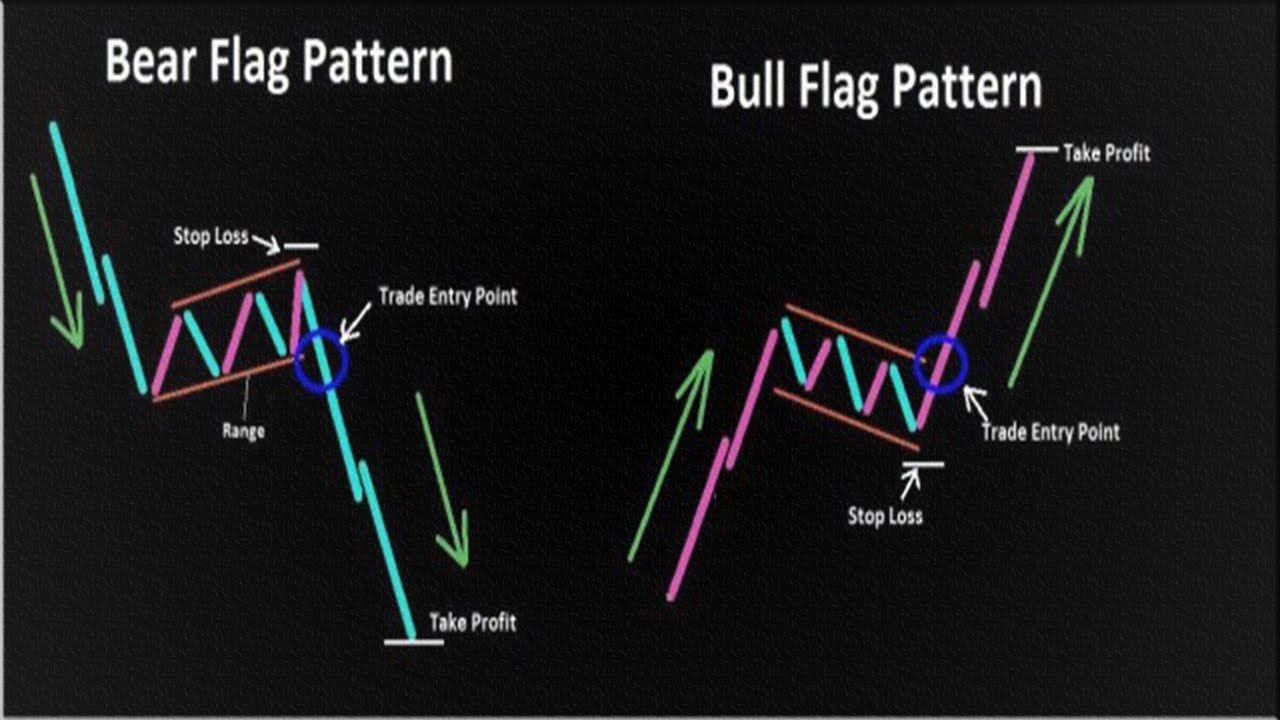

How to Trade Bull Flag Pattern. In this video youll learn how to identify a bull flag pattern how its used to determine potential buy signals and price targets and the risks and goals. A bull flag pattern is a bullish continuation pattern used in technical analysis that occurs in a market that is in an uptrend.

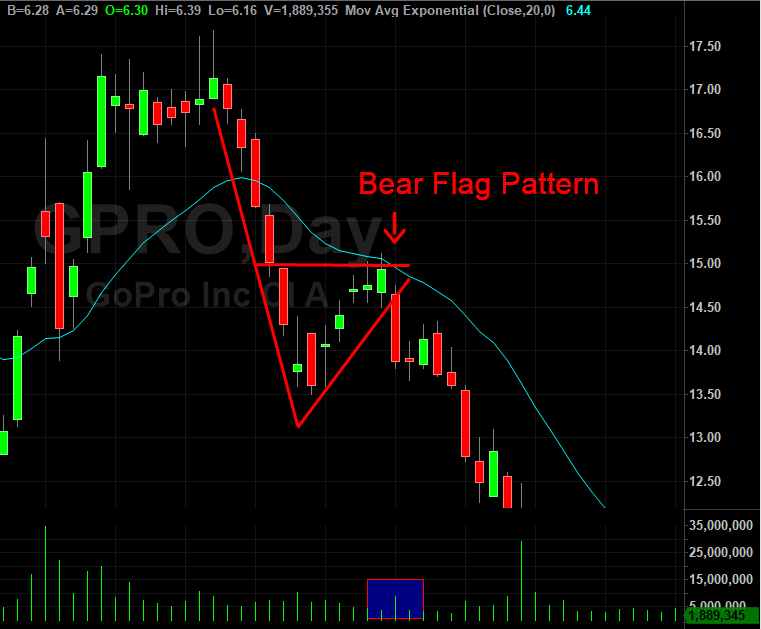

You should trail and hold your pivot point rejection trade. The bear flag pattern on the. A bullish flag pattern forms when price is in an uptrend and retraces.

Traded properly it can be among the more reliable. Its what keeps the stock from rallying again. Look for an impulse move the pole of the flag in price.

You dont want to jump in. In fact we have someone in our trading service that trades strictly bull flags. A Bull Flag chart pattern happens when a stock is in a strong uptrend but then has a slight consolidation period before continuing its trend up.

Price is in sharp up move on high relative volume ACT AS POLE Prices consolidate at or near highs with a defined pullback pattern like flag or pennant or tight. Bull flags have been rare over the last few months of 2008 but they have been beginning to surface in conjunction with the recent market rally. When the correction begins and the price drops.

The bull flag pattern is one of the most sought-after chart patterns. A bull flag is a widely used chart pattern that provides traders with a buy signal indicating the probable resumption of an existing uptrend. In a bull flag pattern there needs to be a 90 price rise or more within a couple months before the horizontal consolidation.

Use a trend line and draw the vertical flag. This chart pattern helps traders choose the best entry and exit. Anything less than that and you have a less bullish flag pattern.

The bull flag momentum strategy is one of those.

How To Trade Bull And Bear Flag Patterns Ig Us

How To Trade Bearish Flag And The Bullish Flag Chart Patterns Forex Trading Strategies Youtube

Bull Flag Vs Bear Flag And How To Trade Them Properly

Flag Patterns Fx Vix Traders Blog

Python Detecting Bull Flag Pattern In Stock Market Data Stack Overflow

How To Trade Bearish And The Bullish Flag Patterns Like A Pro Forex Training Group

What Is A Bull Flag Chart Pattern And How To Spot It

Bull Flag Price Action Trading Guide

What Are Bull Flag Patterns And How To Trade Them

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bullish Flag Formation Hit Run Candlesticks

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn

The Bull Flag Pattern Trading Strategy

Bull Flag Pattern Review How To Trade It Correctly

How To Trade Bearish And The Bullish Flag Patterns Like A Pro Forex Training Group

The Definitive Guide To Trading The Bull Flag Pattern In Forex